b&o tax seattle

Contact the city directly for specific information or other business licenses or taxes that may apply. If your business is a professional services firm like a law or accounting firm and you are filing a local tax return.

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Although there are exemptions every person firm association or.

. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and. File and Pay Your Taxes. 32 rows Business occupation tax classifications Print.

Business occupation tax classifications. T 1 215 814 1743. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes.

CPAs and accounting firms. Manufacturing Processing for Hire Extracting Printing. Business license application help.

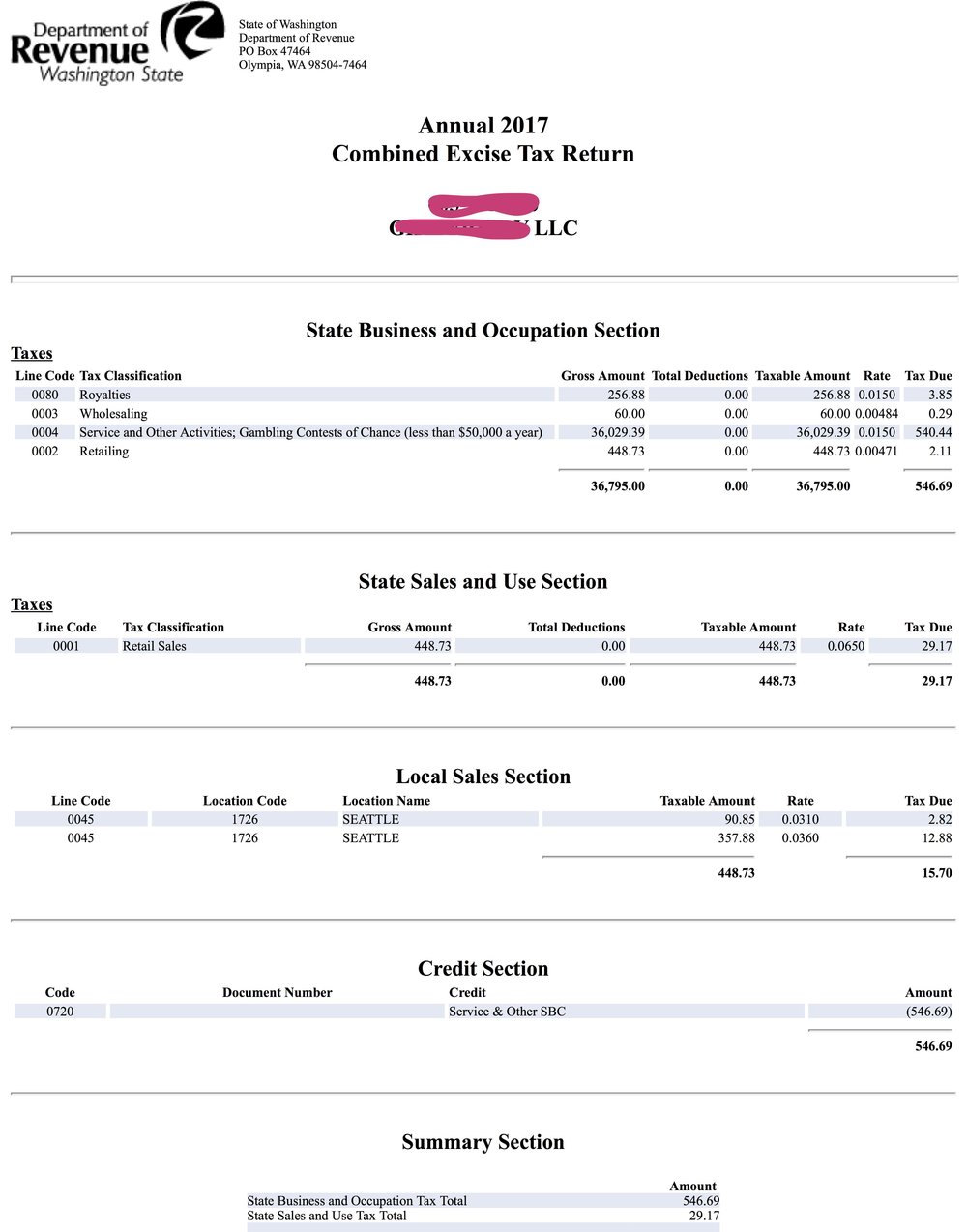

Manage your account online. This table below summarizes Seattle business license tax rates and classifications. The state BO tax is a gross receipts tax.

Washington unlike many other states does not have an income tax. Specialized BO tax classifications. Visit their website for a list of City BO Tax Rates pdf with applicable rates and contact phone numbers for.

Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex. Compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. First enacted as a temporary funding mechanism in 1933 it has been amended tweaked and updated to include hundreds of exemptions exceptions and classifications.

The model was updated in 2007 2012 and 2019EHB 2005 passed in 2017 also established a task force of city and business representatives to recommend changes to the two-factor apportionment formula for service income under RCW 351021303 and. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. The tax amount is based on the value of the manufactured products or by-products.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. See Tax Rates and Classifications. Please have your City of Seattle customer number ready to provide to the representative.

Create a tax preparer account to file returns for multiple clients example. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. If you do business in Seattle you must.

BEFORE YOU GET STARTED. It is measured on the value of products gross proceeds of sale or gross income of the business. The BO tax is calculated based on gross business receipts less allowable deductions and businesses fall into one of two rate categories.

Business Occupation Taxes. You pay the tax if your annual taxable gross revenue is 100000 or more. V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered.

Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax. Washingtons BO tax is calculated on the gross income from activities. Open Monday through Friday 8 am.

Have a local BO tax. Kenmores BO tax applies to heavy manufacturing only. If you need to file a 2021 annual tax return and have revenue.

The payroll expense tax in 2022 is required of businesses with. To 5 pm Monday-Friday excluding City holidays. The current tax rates are 039 per square foot per quarter for business floor space and 013 per square foot per quarter for other.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. Service other activities015. The square footage BO tax is based on rentable square feet.

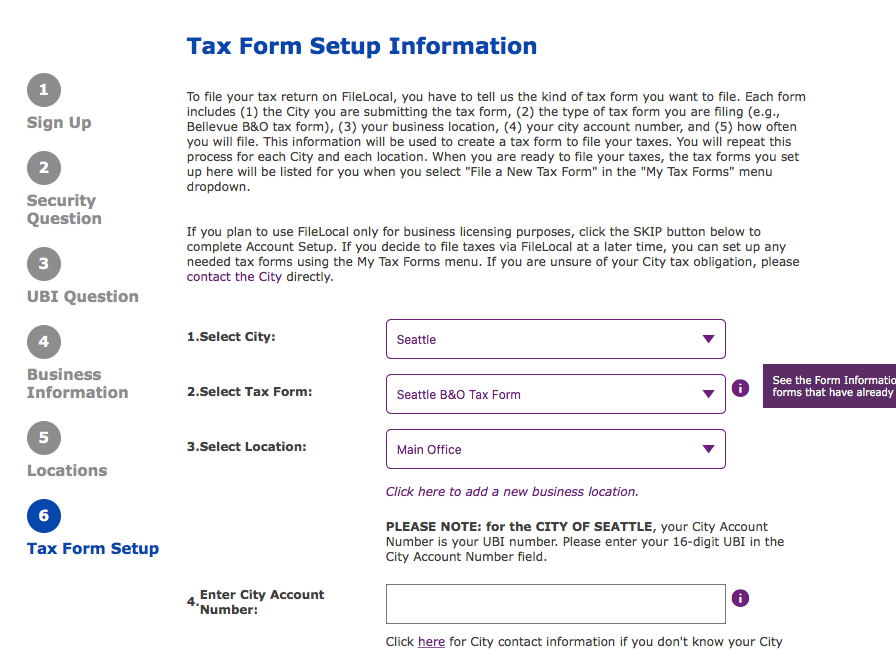

Have a Seattle business license see the due dates for that here file a business license tax return. Create a business account to register your business file returns and pay local BO taxes. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax.

24 2020 the Washington Court of Appeals determined that the city of Seattle used an unlawful method to calculate the citys Business and Occupation BO tax liability of a broker-dealer taxpayer. Browse a List of Business Tax Rules Questions about the content of any of these Rules should be directed to the Department of Finance and Administrative Services by phone at 206-684-8484 or by e-mail at taxseattlegov. Apply for or Renew a Business License.

CREATE BUSINESS ACCOUNT View the Taxpayer Quick Start Guide. Box 34214 Seattle WA 98124-4214. Business license tax certificates.

This tax is in addition to the BO tax imposed by the state of Washington. The Department of Revenue does not administer or collect local BO taxes. Extracting Extracting for Hire00484.

The Municipal Research and Services Center provides information about city BO taxes. This means there are no deductions from the BO tax for labor. 1 Specifically Seattle unfairly apportioned the tax by excluding amounts paid to independent.

If your business is a retail store and you are filing a local tax return for 2017 the tax rate you will pay is 000219 or 219. The square footage BO tax applies to businesses that maintain a business location within Seattle and conduct out-of-city business activities. Not at all say business owners.

And 39 cities in the stateincluding Seattlehave gotten in on the action imposing their own versions of the BO on top of the state tax. The Seattle business license tax is applied to the gross revenue that businesses earn. You may also reach us via email recommended at taxseattlegov or by phone at 206 684-8484 from 8 am.

City Of Seattle Business Licenses

State Supreme Court Upholds B O Tax On Large Banks In Washington Mynorthwest Com

City Of Seattle License Fill Online Printable Fillable Blank Pdffiller

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

B Amp O Tax Return City Of Bellevue

Why Our B O Tax Is Unfair R Seattlewa

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

Excise Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Seattle S Revenues Understanding Mayor Jenny Durkan S Proposed Budget Seattle Business Magazine

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Filelocal Annual Report To Seattle Seattle Business Apothecary Resource Center For Self Employed Women

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

City Of Seattle B O Tax Deferment Information Essential Southeast Seatte

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Self Employed Tax Legal Basics Seattle Business Apothecary Resource Center For Self Employed Women